There are certain topics that people might shy away from discussing – one being money. When learning how to plan and budget our savings, we may find it uncomfortable to think about all of our options. There are so many, yet how do we know which will work best?

Rowan University’s Women’s Alliance Network hosted “Thriving in Times of Change,” a financial workshop that featured panelists who work for TD Bank.

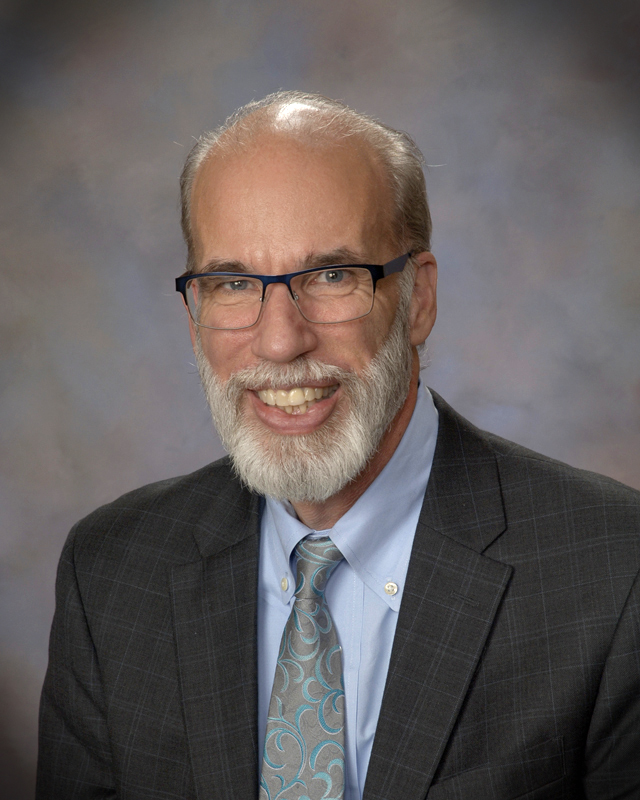

Adam Bracy, the senior relationship manager with TD Wealth Management Services, and Rachael Seaman, the vice president and store manager of TD Bank in Blackwood, New Jersey, shared their advice for how students can begin managing their finances accurately.

When students think about our financial goals, we should make sure that they are obtainable. According to Bracy and Seaman, S.M.A.R.T. goals are those that are specific, measurable, action-oriented, reachable and time-bound.

Students should to ask themselves what it is that they want to accomplish. What is your budget, and what specific actions do you need to take in order to complete your goal? Is it reachable, and can you realistically accomplish it? Finally, students should find out what their timeline looks like for reaching these goals.

Once you follow these steps, it is important to keep track of the goals that you have set.

“Write your goal down. Put it on a piece of paper. Use a picture,” Seaman said. “Use words –anything. Put it up on a wall where you see it every day – that way you remember what you’re working toward.”

It also does not hurt to share your goals with the people around you, in order to keep you motivated.

“Share your goal with others. Let people know what it is that you’re working so hard toward,” Seaman said. “They will help you, and they will support you.”

The most important reminder is to stay focused on the goals that you have.

“Don’t set too many goals for yourself,” Seaman said. “Try to focus on one or two goals at a time. When we set too many goals, it becomes too much, and it’s harder to achieve.”

Another key element in setting specific goals is creating a plan for what lies ahead.

“It’s important to start the planning process early,” said Bracy. “We suggest starting by thinking about your vision for the future.”

Planning also means knowing how you will receive an income, estimating your ongoing expenses, adopting a long-term perspective towards future investments, working with a trusted advisor to evaluate options, checking on the success of your plan in alignment with your goals and understanding hidden costs.

As you begin to organize your financial plan, there are some factors you will need to think about.

First, consider how long you will have to save, then separate “needs” from “wants” and “wishes.” It’s also important to incorporate your future income sources, and consider transition options.

TD Bank has made it their mission to deliver excellent customer service to its clients during COVID-19. No matter how you decide to tackle financial planning, choosing a bank that delivers quality care is a great first step.

“It really comes down to the relationship and trust that you’re able to instill in your bankers,” said Bracy. “We do a lot in the community. It’s been a little challenging this year – because of COVID – but you see TD out in the community, helping a lot of organizations and nonprofits, and it really does come back to the relationship that we are able to provide our clients.”

For comments/questions about this story, email [email protected] or tweet @TheWhitOnline.

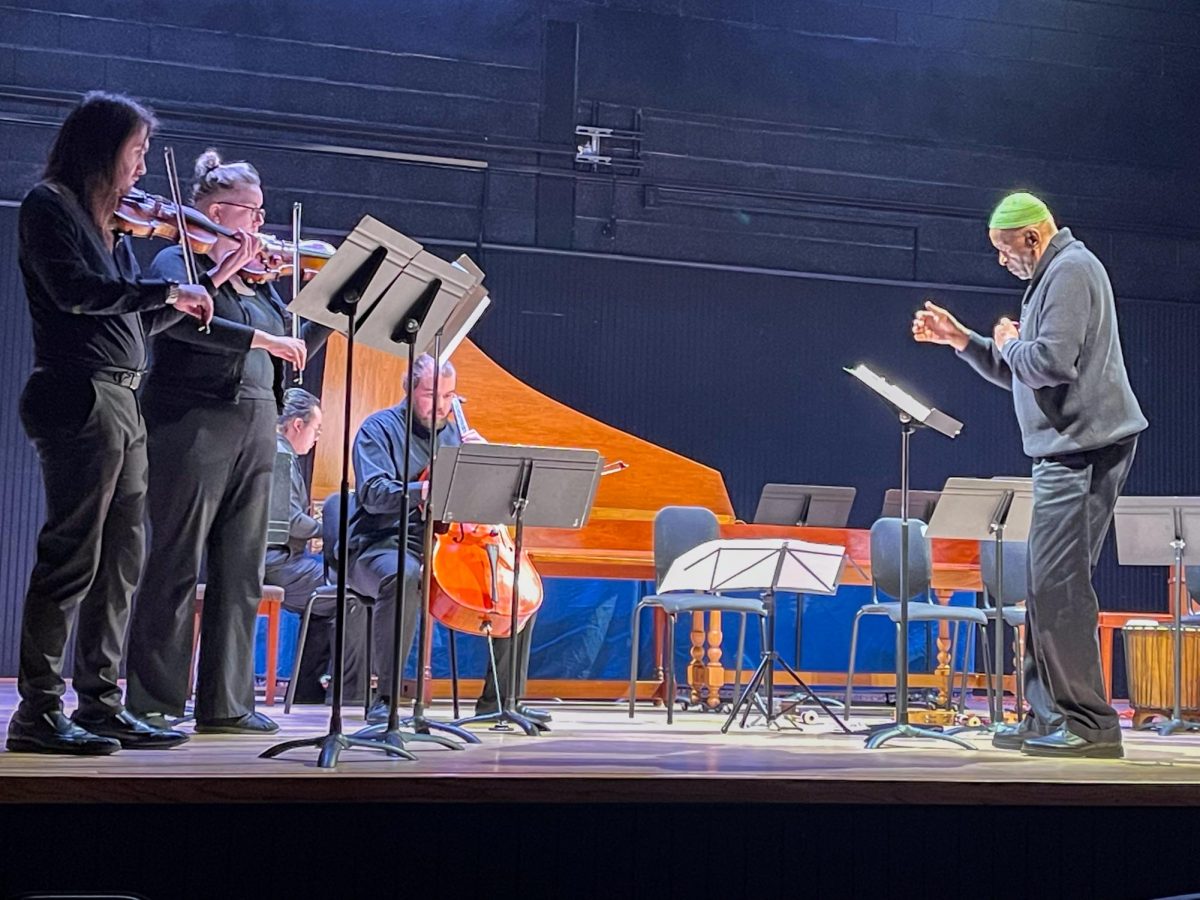

!["Working with [Dr. Lynch] is always a learning experience for me. She is a treasure,” said Thomas. - Staff Writer / Kacie Scibilia](https://thewhitonline.com/wp-content/uploads/2025/04/choir-1-1200x694.jpg)