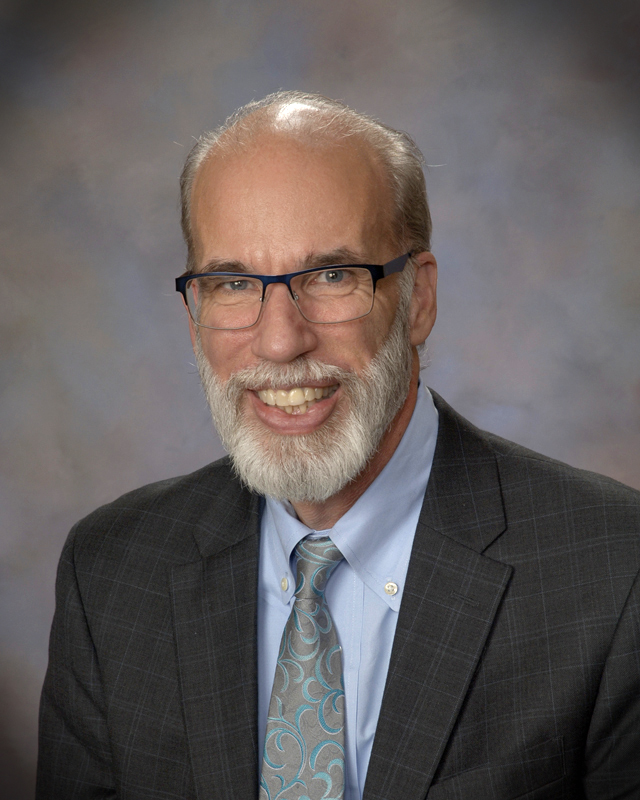

Economist Dr. Douglas Webber presented to students and professors on Monday in the Chamberlain Student Center. He spoke on whether or not the cost of a college education is worth it, and what elements play a part in answering such a complex question.

Webber is an associate professor, director of graduate studies in the economics department at Temple University and a research fellow at the Institute for the Study of Labor. His main interests are labor economics and the economics of higher education.

In May 2015, he testified before the Senate Committee on Health, Education, Labor and Pensions. He articulated his advocacy for risk-sharing policies within the higher education system by highlighting reforms of accountability to eliminate predatory practices from schools and protect students and taxpayers.

Webber began by addressing what he believes to be the sticky situation of evaluating the return on investment (ROI) of a college education. Webber went on to discuss how much debt a student should actually take on and how personal background and one’s particular abilities play a part in the decision.

Much of his work focuses on the lifetime return on college degrees. He believed there are often two different perspectives that many people draw when it comes to a graduate’s income after college: Are people earning more money because of their degree or were they just smart in the first place?

Webber concluded that the answer lies somewhere in between. He assumes in most cases, the causal effect of a degree is about two-thirds, while the remaining third is fulfilled by the student’s innate ability. However, Webber noted this differs on a few variables found in any case-by-case basis. In addition to this idea, he also pointed out the differences in earning by major.

He notes that the selection of a major does play a key role in the amount of earnings when a student graduates with their degree. Business and STEM majors tend to come out on top, while humanities and two-year programs come in at the bottom, earning just above the median of students with a high school diploma.

The main point of the discussion came to fruition when Webber came to answer the question we all hold near and dear to our hearts: Does college pay off?

According to Webber, it once again depends.

The first element is selection: Who is going to college? On average, according to Webber, people smarter than the average person attend college. For someone who academically performs on par or below average, a college education might not be as great of an investment.

The second element is discounting.

“If you had the chance to take $100 today or $100 in 10 years, what would you pick?” Webber said.

He translated this philosophy to an investment in education: Do it now, and it will pay off in the future.

The third and most articulated point in Webber’s dissection of the question concerning the possible enrollment in college is the reality of graduation uncertainty. He was clearly frustrated with the idea that society often, and almost exclusively, highlights the benefits of a college degree, while dismissing the fact that many will not finish their degree requirements.

“College is probably the safest single investment you can make, but people over-inflate the likeliness of success,” Webber said.

He adds that people often promise an investment in college education will pay off for 90 percent of those invested, when that is not the reality.

A college graduate’s probability of earning more than someone who received their high school diploma is really high, according to Webber, and part of that is because the bar is lowered due to the labor market.

Webber also points out a graduate with no expenses (full-tuition scholarship, no book costs, etc.), will have a 74 percent chance of earning an excess of $500,000 more than someone with a high school diploma in their lifetime. This comes to about a 60-65 percent chance for a college graduate bearing the average cost of a college education. Rowan, he said, does well with its repayment rate, towards the upper percentile of repayment rates.

While spending in the area of higher education has increased more, the amount of people attending college has risen even higher over the years, not keeping up with the rate of state spending. For example, Temple University’s state appropriations have remained the same since 2000, but the school has doubled in population, according to Webber.

Disproportionately, everything goes to Medicaid. While higher education spending is going to Medicaid, the same people who advocate for more Medicaid spending are doing the same for higher education spending, according to Webber.

Webber concluded with the possible future directions of higher education. Citing his own research, he believes there will be future cuts for extremely low performing schools, a rise in income-share agreements, reform in student loan repayment plans and free college.

Webber’s research is also available online. It includes a PDF of his written 2015 testimony to the Senate HELP Committee.

For comments or questions about this article email [email protected] and tweet @thewhitonline.com

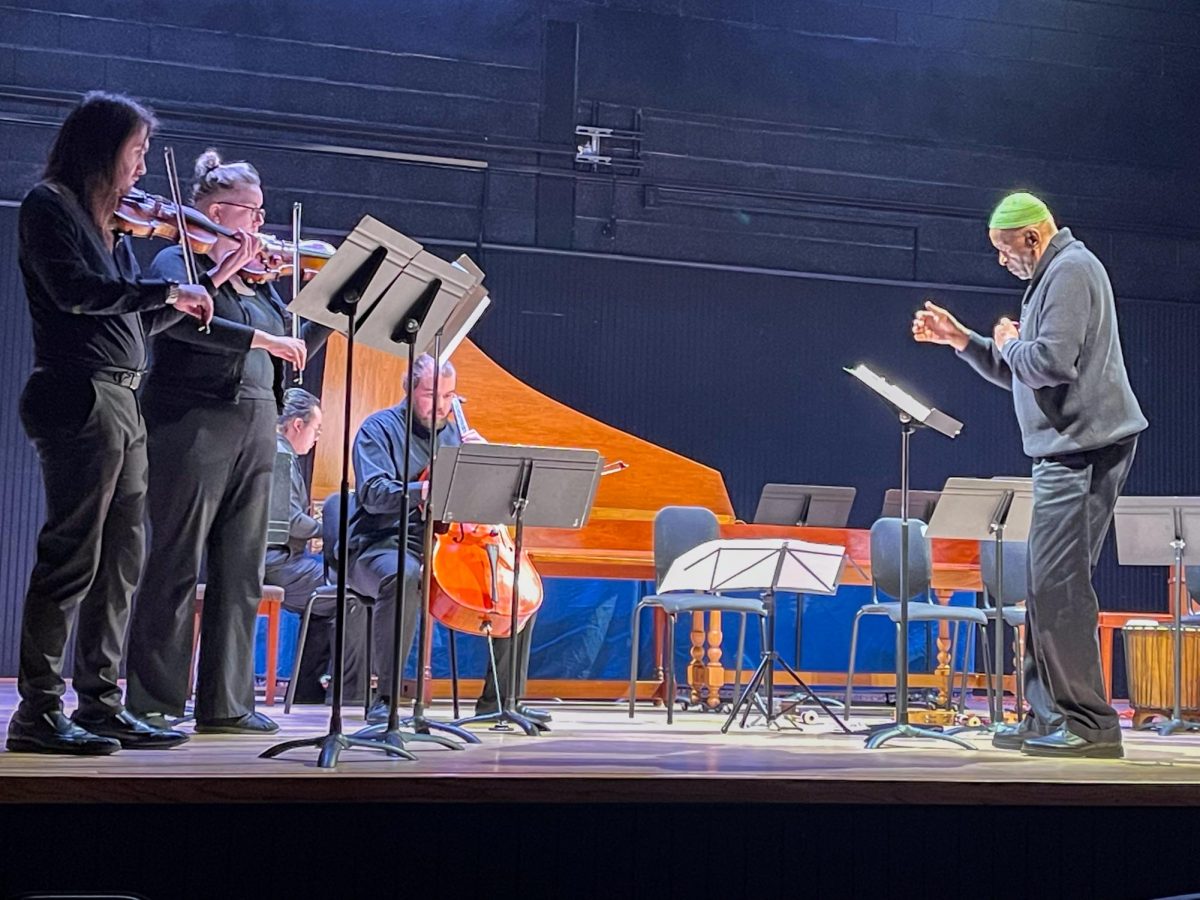

!["Working with [Dr. Lynch] is always a learning experience for me. She is a treasure,” said Thomas. - Staff Writer / Kacie Scibilia](https://thewhitonline.com/wp-content/uploads/2025/04/choir-1-1200x694.jpg)