On March 5, 2021, Rowan University filed a lawsuit against Factory Mutual Insurance Co. (FM Global) for losses sustained due to campus closure during the coronavirus pandemic.

The Fortune 500 insurance company, FM Global, covers 24 insured locations in New Jersey owned or operated by Rowan University.

According to the claim, Rowan University believes FM Global violated its “all-risk” insurance policy when it made a blanket decision to deny all business income claims pertaining to COVID-19 losses.

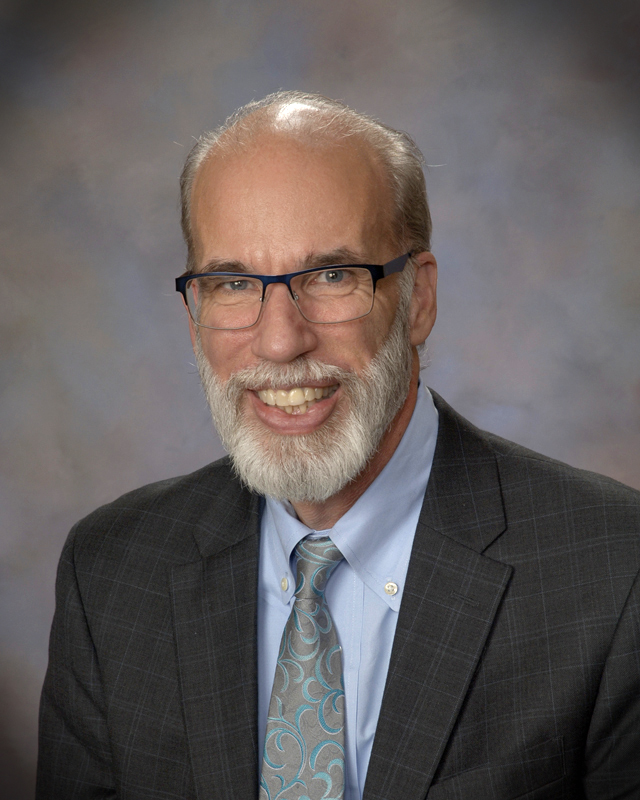

“Blanket decisions from carriers, especially in this situation with COVID-19, are when carriers make a uniform decision across the board regardless of the specific facts of any individual loss,” explains Mario Barnabei, a Philadelphia-based insurance lawyer. “They made a pre-determined decision on these claims that they would deny all of them as there is no indication of direct physical loss to the properties. This wasn’t just made by individual carriers but across the board in the insurance industry.”

Rowan University is taking a stance that FM Global failed to make a good-faith investigation to determine coverage and adjust Rowan’s claims because it reached a pre-determined conclusion to deny coverage.

“What is required under New Jersey law, and in most states, is that carriers make a good faith effort to investigate a claim. One of the allegations that come often with these blanket denials is that the carrier didn’t actually make a good faith effort to investigate the loss,” Barnabei said.

According to Rowan’s insurance policy, FM Global is supposed to include coverage for business income losses/extra expenses, civil authority, interruption by communicable disease, decontamination costs, communicable disease response, protection, and property preservation.

“There is coverage under (Rowan’s) policy. The big issue is that viruses are included under the term contamination. Under the policy, there is coverage for direct physical loss caused by contaminants. When you put all the facts together, the argument that should win the day is that the policy provides specific coverage for contamination,” said Barnabei. “The virus is physical damage in the sense that it acts the same way as something like soot; just because you can’t see it or you can clean it away doesn’t mean it isn’t damage. Those cases have been the ones that are most successful so far when there isn’t a specific virus exclusion within the policy.”

Rowan University hasn’t specified any compensatory damages for FM Global’s alleged breach of its insurance policy contract and refused to comment on this pending litigation.

Like many other insurance companies, FM Global has been busy over the last year defending themselves in court to get out of paying the considerable amounts allegedly owed to their policyholders due to the pandemic.

According to the University of Pennsylvania COVID Coverage Litigation Tracker, since March 16, 2020, a total of 1,497 cases have been filed against insurance companies over pandemic coverage.

On March 11, Sacramento Downtown Arena LLC (the Sacramento Kings’ basketball arena) was the second NBA arena company after The Houston Rockets to sue FM Global since the onset of COVID-19.

Rowan University isn’t the only public education institution to file a recent claim against FM Global; on March 12, The University of Colorado also issued a claim against the insurance company.

“Insurance companies are a business, and the way that business makes money is by not paying claims. They will continue to take and hold a position of no coverage for viruses and, candidly, anything they can hope not to pay,” said Barnabei. “Something I think will change about insurance providers is the inclusion of new language in the policy that focuses on viruses and pandemics. If a carrier doesn’t want to pay for this, they need to make it crystal clear in the policy.”

According to Barnabei, insurance policies are known as a contract of adhesion, one written by the insurer and accepted by the customer. Policyholders have no say in how the agreement is registered but can either accept or deny it.

“If there is any ambiguity or confusion in the policy or how it is covered, it has to be read in favor of the insured. When this pandemic is over, and new policies are issued, I can nearly guarantee there will be a new endorsement on a large majority of policies, being crystal clear that the companies have no intention of paying if (a pandemic) is to occur again,” said Barnabei.

For comments/questions about this story, tweet @TheWhitOnline.

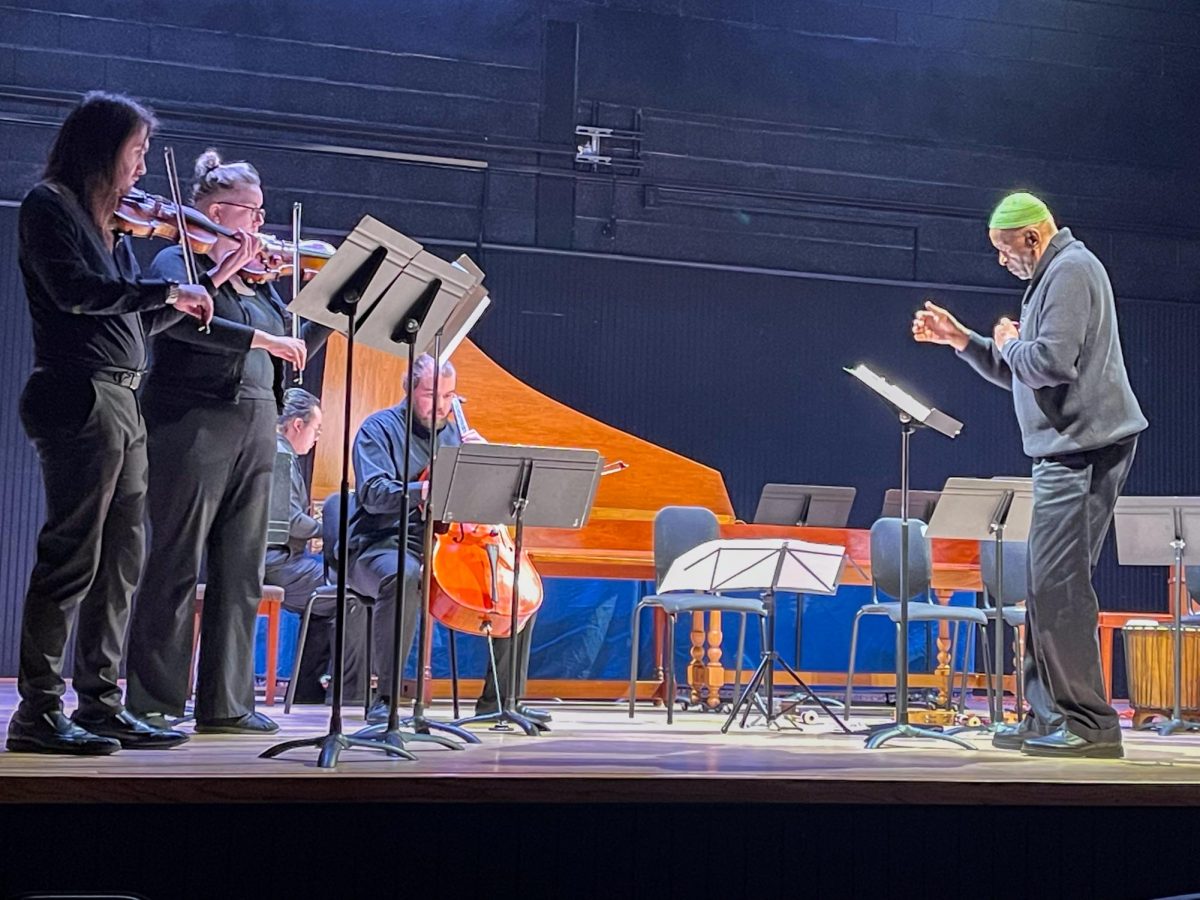

!["Working with [Dr. Lynch] is always a learning experience for me. She is a treasure,” said Thomas. - Staff Writer / Kacie Scibilia](https://thewhitonline.com/wp-content/uploads/2025/04/choir-1-1200x694.jpg)