As college students continue to navigate the daunting twists and turns of university life during a global pandemic, it’s not surprising to learn that life on campus can quickly become a financial vortex during a time when finances, for many, are already unnervingly tight.

What separates us from students of the past is the addition of Covid-induced financial burdens, in conjunction with the already-existing and ever-present financial struggles of students attempting to navigate their newfound independence, while still keeping up with the lifestyle of campus culture. According to a 2021 survey of over 20,000 college students, published by the American International Group (AIG), over 19% of college students have taken on more debt since the onset of the pandemic, while 16% are working fewer hours and 10% have lost their job.

Because of these Covid-induced financial hardships, many students are having increased difficulties managing their finances. According to the same AIG survey, at least 42% of students are not confident in their ability to manage their personal finances, with about 40% of students having accumulated over $1,000 in credit card debt and 38% uncertain of their ability to pay off the entirety of their monthly credit card bills.

Apart from the costly aspects of college life that we’re all familiar with—like the overbearing prices of tuition—there are a number of financial pitfalls that many of us, sometimes unknowingly, inevitably fall victim to.

So, what are they, and how do we work smarter, not harder, with our money?

University Merch and Pressured Purchases

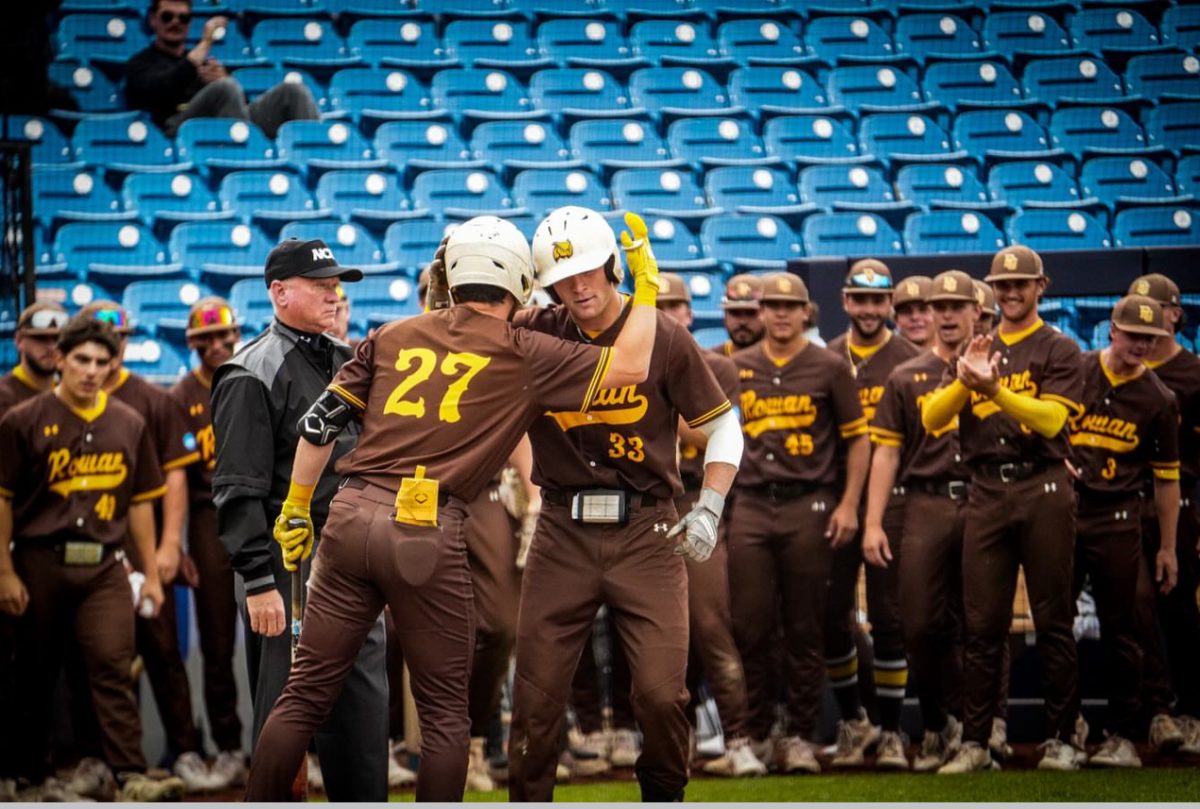

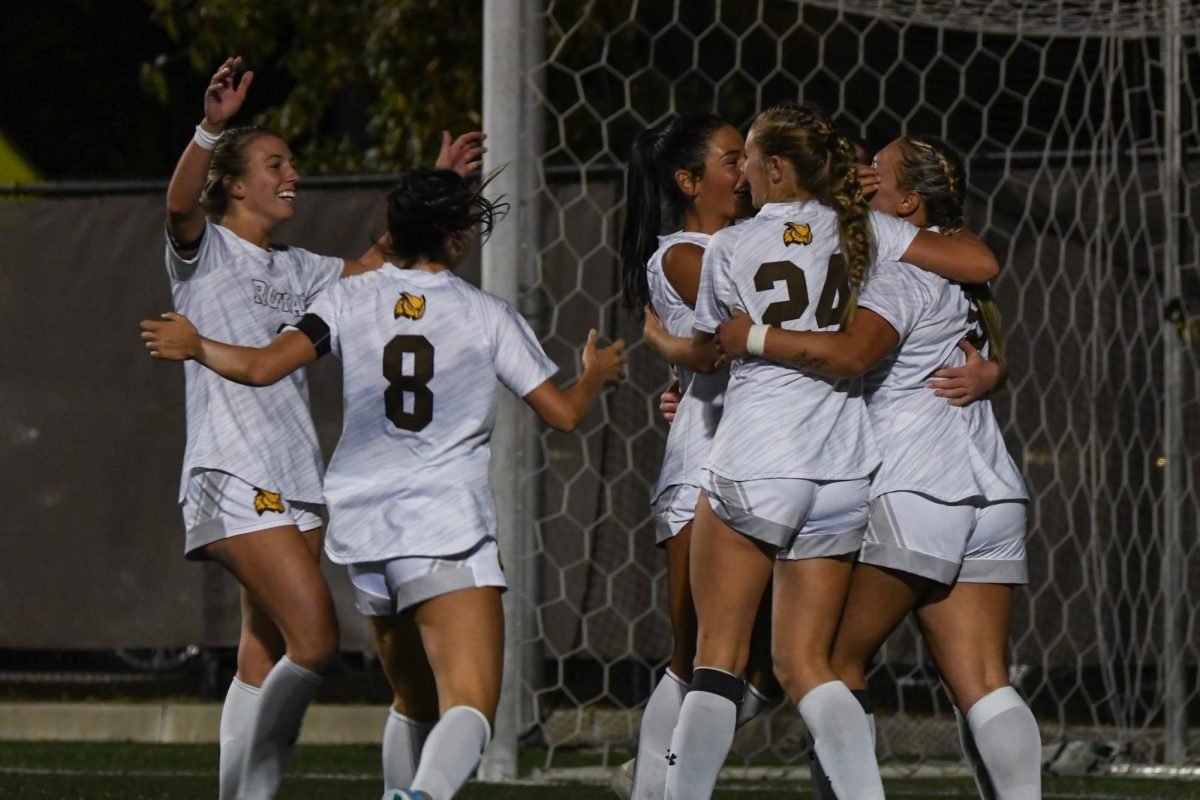

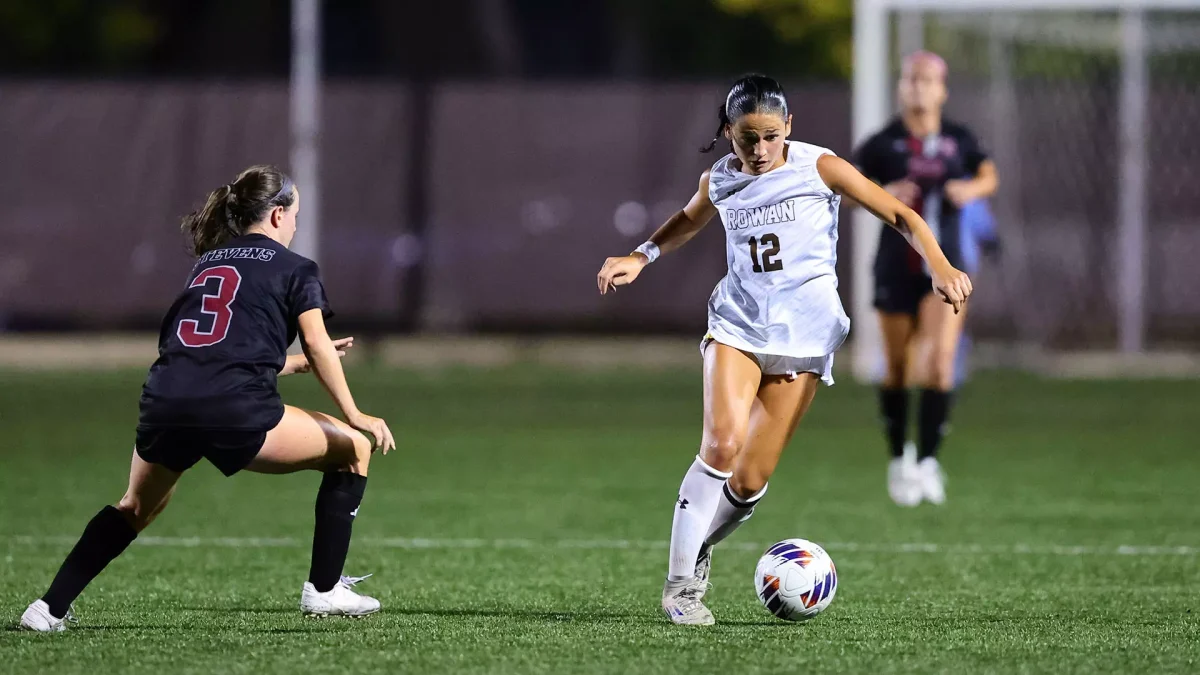

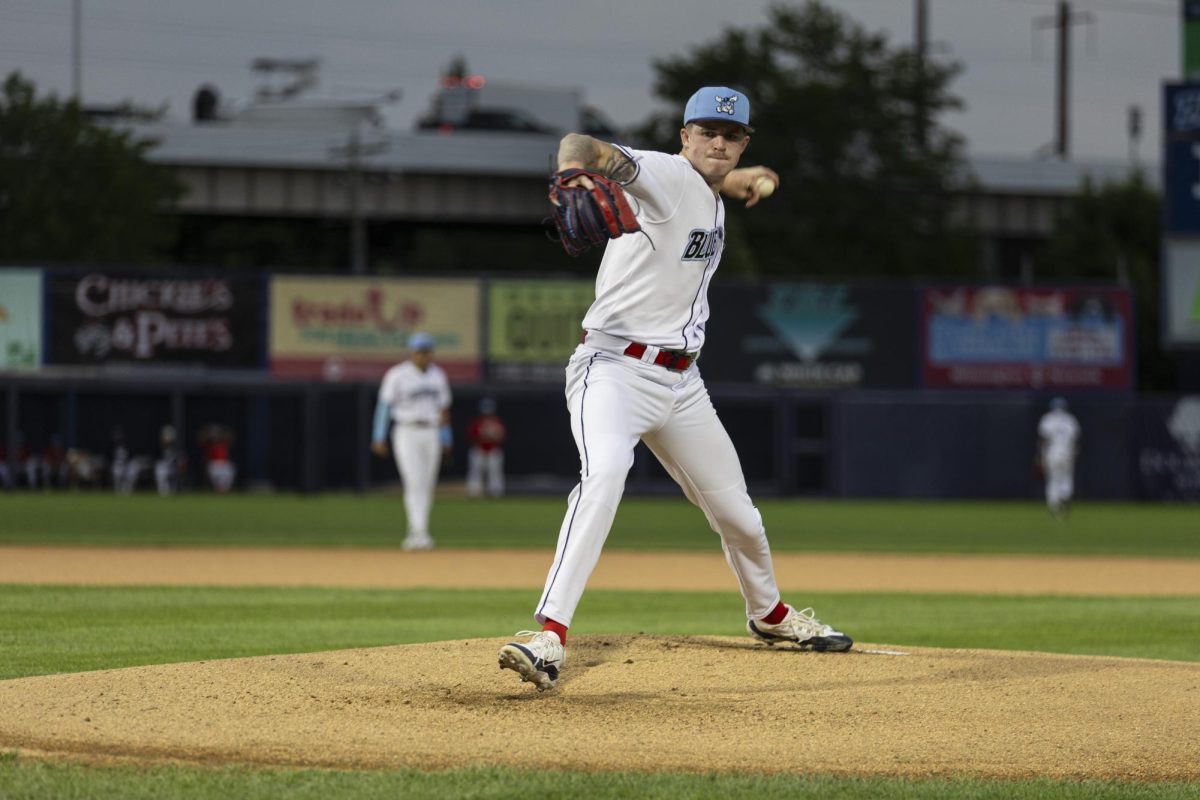

We get it. There’s a sense of pride that comes with attending your university. There’s also a sense of pressure that accompanies your day-to-day life on campus. There’s pressure to buy what’s new and in style, whether or not it’s in your budget, and pressure to represent your school as much as those around you.

But are these purchases, as “normal” as they may be for students, really reasonable for the prices you’re paying?

Rowan sweatshirts, sweater vests and other winter garments alone can cost up to about $80, not to mention the T-shirts being priced at up to $35, joggers falling at $80 and baseball caps at $25.

Before you make the purchase, ask yourself if it’s really necessary and really in your budget.

Going Out and Eating Out

For many, the intensity of the school week is followed by the entertainment of nights out, whether it be out partying or grabbing drinks at a local bar. For the average college student looking to budget their funds, going out to dinner and purchasing rounds of drinks or bar food can add up more than you realize .

In most cases, the price of eating out around campus tends to be higher than that of eating out away from a college town – because colleges are banking on students looking for convenience, not affordability.

While this isn’t to say that students should never head out to a bar on campus again, it does suggest that you might be draining your bank account more than you realize by neglecting the enjoyment and potential savings that can come from having a night in with friends, cooking when possible and limiting your nights out.

Lack of Budgeting

While financial freedom and independence, often start in college, budgeting doesn’t always seem to follow suit. According to a 2020 survey of recent college graduates, conducted by College Finance, nearly 73% of respondents reported the cost of books being far greater than expected, while 57% found the cost of parking higher than expected and nearly 40% found that taking part in social activities and outings was far more expensive than they had planned.

Needless to say, universities often surprise us with how much they expect us to fork out in order to live, learn, and create a life on their campus—which is why you must plan ahead.

When it comes to creating a sustainable financial plan in college, mapping out as much of your day-to-day life as possible is what could save a lot of students a lot of debt, or at the very least, lower the amount of unnecessary, avoidable debt you accumulate.

It’s important to take into consideration the cost of school necessities, like books, parking or housing, as well as everyday essentials and amenities, like food, gas, toiletries, electronics, and more. Keep the basics in mind, then factor in your university apparel, nights out and DoorDash orders, without shifting your financial priorities.

Take Advantage of Your Resources

Obtaining an education is expensive, but the lifestyle that comes with living on campus can often create myriad temptations for overpriced purchases that could be avoided with careful consideration of your options.

Take advantage of Rowan’s financial aid resources, including their loan programs, scholarships, and tuition-free opportunities.

Rent your textbooks or borrow from a friend when possible. Attempt to spend more nights in with friends, cooking meals at home when possible. Look into cheaper alternatives for the expensive purchases you might make out of impulse or habit, and limit yourself on bar, merch and convenience-based purchases throughout the semester.

Yes, you should still immerse yourself in what will become “the good old days,” but do so with as much financial caution as possible. As university students, we must ask Rowan, when will the financial constraints and limitations of students be taken into consideration when pricing our food, textbooks and Rowan attire? Students have enough weighing on their bank accounts, it’s time for the university to stop adding to this weight in unnecessary ways.

For comments/questions about this story, tweet @TheWhitOnlineor email [email protected].

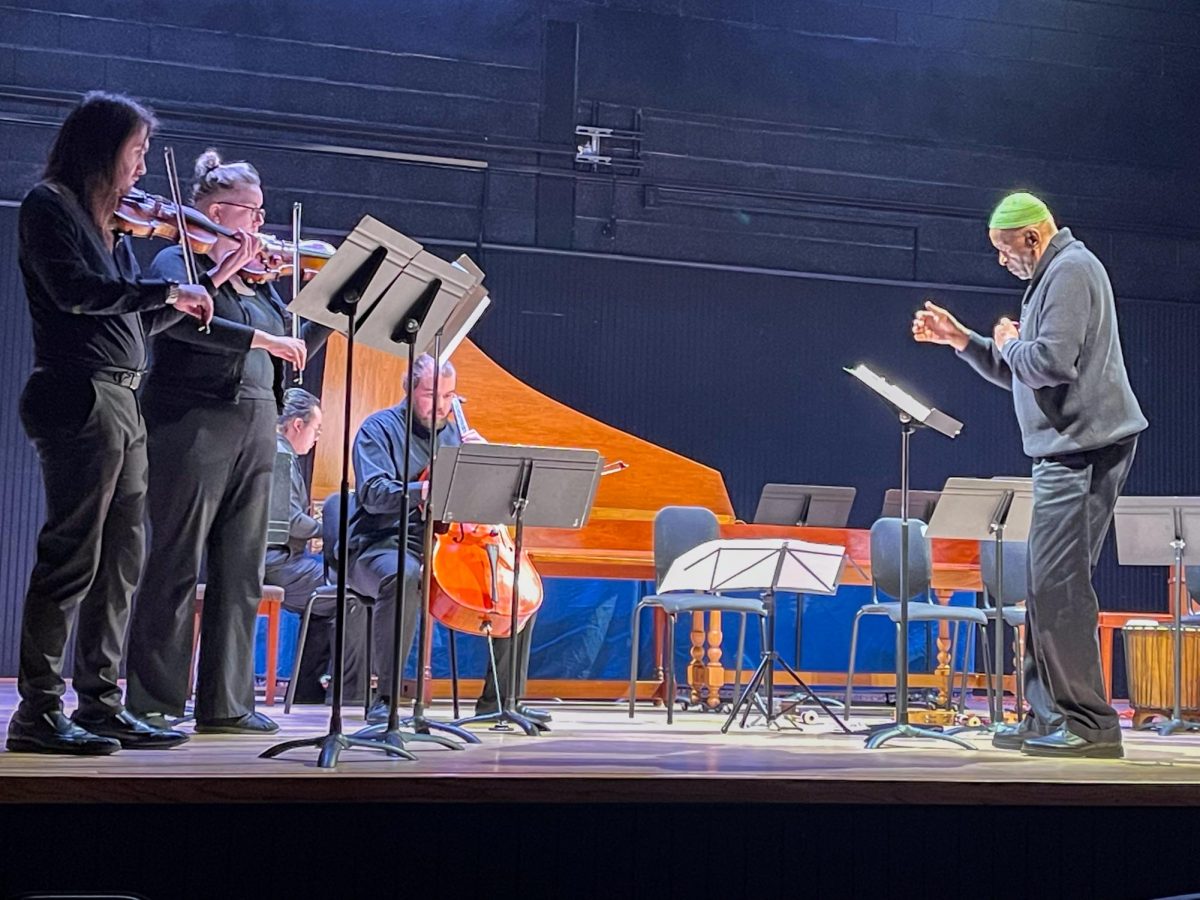

!["Working with [Dr. Lynch] is always a learning experience for me. She is a treasure,” said Thomas. - Staff Writer / Kacie Scibilia](https://thewhitonline.com/wp-content/uploads/2025/04/choir-1-1200x694.jpg)