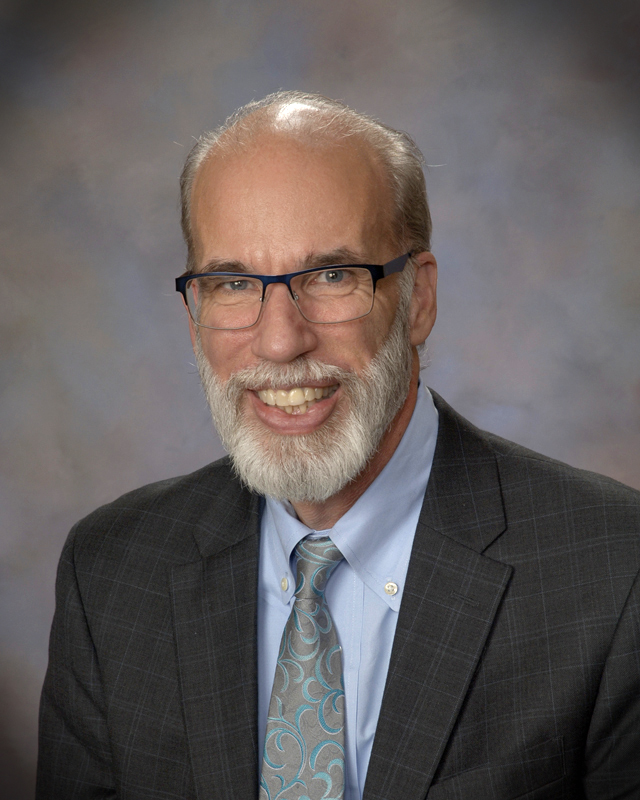

On Tuesday, Feb. 13, President of the Federal Reserve Bank of Philadelphia Patrick Harker spoke to members of the Rowan community in the Eynon Ballroom in the Chamberlain Student Center to discuss his role in the Federal Reserve System (The Fed) at the second Rowan Institute for Public Policy & Citizenship (RIPPAC) Speaker Series conference of the semester.

The Fed is an independent institution tasked with promoting the health of the United States economy and stabilizing its financial systems and actively works to balance inflation to a desired rate of two percent, set interest rates, and conduct open market operations.

Harker, a former engineer and President of the University of Delaware, has served as the 11th President of the Philadelphia bank since 2015, one of 12 total branches across the country which holds for over 100 members across Eastern and Central Pennsylvania, South Jersey, and Delaware.

He started off his speech by giving a little lesson about the history behind The Fed and the U.S. economic systems.

In 1791, the First Secretary of the Treasury Alexander Hamilton established the First Bank of the United States, an institution that stored federal government funds and handled their financial and administrative responsibilities and eventually failed in 1811, after its charter wasn’t renewed. Following a period of recession, Hamilton then authorized the creation of the Second Bank of the United States in 1816.

However, in an era known as The Bank War, its existence became a heavily debated political issue. President Andrew Jackson, the Second Bank’s most vocal opponent, vetoed its charter in 1832, four years before it was set to expire and it inevitably fell in 1836, leading to its funds being disbursed into smaller state banks.

After decades with no federal banking system, the U.S. economy appeared almost in a constant state of crisis. It wasn’t until after the Panic of 1907 that calls for reform started up again and The Fed was finally opened on Dec. 23, 1913.

“After the particularly stressful Panic of 1907, a financial storm matched only by the 2008 banking crisis and exceeded only by the Great Depression, the need for a new system of central banking became evident,” said Harker. “Out of that experience came the Federal Reserve System itself, a truly American institution and a truly American innovation.”

While both the First and Second Banks did not have the power to manage monetary policy, The Fed did. Even with these major responsibilities, The Fed isn’t controlled by the U.S. government but by a board of seven governors in Washington D.C., members who are nominated by the president and then confirmed by the Senate.

While The Fed remains a separate entity from the federal government, it still remains heavily involved with the economy. As Harker puts it, The Fed is a “decentralized central bank.”

Operating under the conditions that Congress creates through law, he says staying away from the drama of politics allows them to do their jobs adequately.

“I think it’s really important because politics as a result does not enter into our decision. We are independent within the government and we do not step explicitly into the political arena,” said Harker.

Harker then began answering questions from attendees at the conference, given to him by RIPPAC Director Ben Dworkin.

On issues surrounding the economy returning to a state of normalcy after the COVID-19 pandemic, Harker says that he is skeptical that things will ever be exactly like they were before. Citing social changes, like the commonality of hybrid work schedules and the behavioral delay amongst children due to taking classes virtually, he explains that from an economics point of view, he doesn’t quite know how to interpret things yet.

“I think the work issues are clear, but from a broad macroeconomic point of view, It’s not obvious,” said Harker. “Some of the data we’re seeing is that a host of measures are basically moving if not completely back on these trends that were there before the pandemic, but in terms of economy, I don’t know and it’s going to have to play out.”

Looking at the relationship between U.S. debt and the economy, Harker raises some concerns. With the debt making up 123% of the country’s gross domestic product (GDP) in 2023, equating to over $33 trillion of debt, he says that in the long run, the country should try to decrease spending and increase revenue to help to alleviate the problem and create a more stable future for younger generations.

“In the long run we [the U.S.] can’t, we have run an unsustainable path,” said Harker. “We’re just kicking the can down the road for our grandchildren and it’s a serious problem and it’s crowding out everything else that we can do.”

As for economic growth, Harker says that two things are required to strengthen the economy: productivity and work. However, while more jobs have been created, he says the productivity levels haven’t really moved. To find more workers, he says society needs to find the talent that exists in people many wouldn’t consider, like immigrants and those in poverty.

“The question and it’s way beyond my paygrade is would we accept that as an American society? Would we accept the definition of global power that would result from that? That’s not an answer I can get. But it is a question that I think we pose,” said Harker.

Harker also discussed the March 2023 collapse of Silicon Valley Bank, politicians’ distrust in The Fed’s proceedings, and new sources of energy like wind power.

For freshman Fiona Currie, the thing that stood out the most to her about Harker’s conference was how the economy and society changed as a result of the COVID-19 pandemic.

“I thought it was really interesting when he mentioned the lasting economic changes of the pandemic and how maybe it’s not as big as we thought it’s more like social changes. It’s definitely something I’m gonna think about more,” said Currie.

To wrap up his speech, Harker motioned to students in the front row of the seating area before saying that they would become the next generation of leaders. Reflecting on his own life, he explains that while peoples’ journeys might not always be easy, things will turn out for the best and everything will eventually fall into place.

“Doors open, doors close, some of those I didn’t want to but you know, it all worked out and I’ve been very blessed by having a great and varied career,” said Harker. “And I have no regrets, but I see for myself and my children the anxiety about the result and it is scary. But, you’re there and all you can do is keep going–just keep moving and keep learning.”

For comments/questions about this story DM us on Instagram @thewhitatrowan or email [email protected].

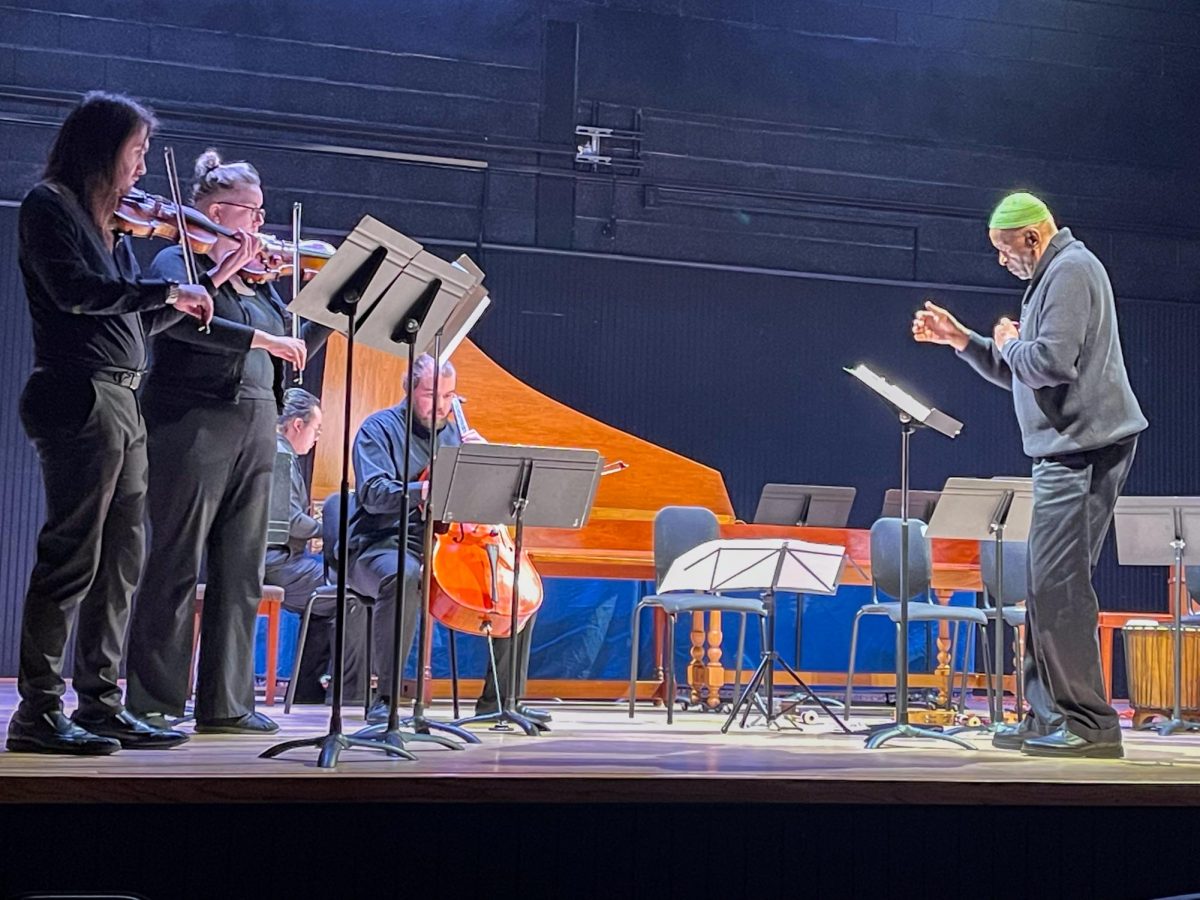

!["Working with [Dr. Lynch] is always a learning experience for me. She is a treasure,” said Thomas. - Staff Writer / Kacie Scibilia](https://thewhitonline.com/wp-content/uploads/2025/04/choir-1-1200x694.jpg)